I’ve tried to write this blog a few times over the last year – and failed.

So here is another brief attempt that sets out for me some of the primary considerations that need to be reflected in our fiscal systems – which I assert are now completely out of sync with the world we live in, and the world we need to create if we are to avoid the worst impacts of climate change and address some of the destructive consequences of inequality.

In doing so, I have also re-used a little content from my Climate Change[i], Wales[ii] Transit Oriented Development[iii] and Car[iv] blogs(and others) and acknowledge that covering the subject of taxation quickly gets very complex and exposes how much I don’t know!

Nonetheless, I hope my brief analysis sets out some valid proposals and also shows that Wales is perfectly capable of addressing these issues and opportunities as an independent country.

I’m not offering an easy answer here….clearly there are devils in details!

Again, as a blog, I reserve the right to edit and revise in response to comments from others and more reflection on my part. Like all my blogs I am hopefully trying to share ideas to provoke debate, some of which may end up having an impact…and some not.

Postscript: In the few days this blog has been up I have received some good challenge re:realistic tax revenue capacity, wealth creation, growing long term liabilities like pensions and transition costs & disruption. I have added a brief section to address…

Post Script March 2021. I don’t know how this passed me by, but I’ve only now just become aware of and have now read “Doughnut Economics” by Kate Raworth. Key learnings: economics is not a science, it has no fixed laws (not matter what some might say), and the prevailing economic philosophy of the last century is completely unsustainable and has to change – especially the focus on GDP and growth – so that we live in the doughnut (see figure below). In essence we have to develop a society and an “economy” with a focus on wellbeing and living within out planetary means. None of my ideas and reflections below and in other blogs are new. In fact it was reassuring to see that at least some of my initial ideas have been much more rigorously developed and eloquently presented by the likes of Kate Raworth. They are just a further smaller voice in a call for change that is increasing in volume! For example the Rethinking Economics movement…

I also accept the argument presented (and vociferously made by others (like George Monbiot) that we have to stop valuing things in terms of £££. However, we live and operate in the economic system we have…and the “easiest” way to change behaviours quickly (and we need to move quickly) is to price and apportion externalities …..in advance of a transition to a more environmentally equitable economic system?

Progress and Inequality

Some aspects of capitalism and free markets have brought millions of people out of poverty across the globe[v] Figure 1, have accelerated the implementation of new technologies, enhanced life expectancy[vi] Figure 2 and improved the quality of life for many people. On many measures the average across the globe has shown improvement.

Figure 1 Number of people in extreme poverty, “Our World in Data”

Figure 2 Life Expectancy, “Our World in Data”

Whilst many of the global data sets show improvements, there are some some emerging contradictory signals [vii] , especially as regards inequality Figure 5. For example, whilst income inequality between countries has been falling, income inequality within some countries has been increasing[viii]. For example, in recent years improvements are not so apparent in the more developed economies like the UK and even more so in USA Figure 3 Figure 4, where it seems on some measures we are “going backwards”. If anyone has been to Los Angeles you will be aware of the huge problem of homelessness and in England, the number of rough sleepers has increased by 250% since 2010![ix].

Something is not quite right.

One of the biggest “learnings” of Covid, is that the people who are most valuable to society, in general, get rewarded the least – so healthcare workers, nurses, delivery drivers, etc. Covid has shone a light of some of the inequality that needs to be addressed.

We also know that globally, the degree one experience “inequality” is more to do with when and where you are born, and less to do with your own efforts.

Figure 3 Share of Income in UK and US, From World Inequality Review 2018

Figure 4 US Life Expectancy[x]

Figure 5 Top 10% National Income Share, From World Inequality Report 2018

Climate Emergency

To compound our economic challenges, we have to add the Climate Emergency. Climate Change is real, is caused by us and without dramatic action, will have a runaway effect and serious impacts for Life on Earth. Politics and its institutions have and are continuing to fail us in both recognising the scale of the challenge and in bringing forward measures to mitigate. If you still “don’t believe”, please look at NASA[xi] and Intergovernmental Panel on Climate Change[xii], etc.

Figure 6 – Source NASA – Levels of atmospheric CO2

So, I would argue whilst there is still an arc of “progress”, not everyone has benefited equally and in recent time a failure to regulate and direct markets has left us with new issue and challenges – especially those related to the environmental catastrophe being unleashed.

I will let the economists comment on this, but it seems to me that the law of supply and demand and the consequent “efficient use of resources” to maximise profits has not but should be constrained by the environmental costs of using those resources. The problem is that for decades we did not really see those costs – but they are there, and we are now all paying the price.

Corporate Responsibility and Taxation

Automation and technology are also changing how value generated though our economic activities is distributed. In the 1920s, rich entrepreneurs employed thousands of people (Getty, Rockefeller, Ford, Carnegie, Firestone, etc….). Those jobs were hard and not always well paid, but they did at least help share some of the economic dividends by re-cycling some of the value created – often very locally.

Today Bezos, Musk and their like generally employ/employed far fewer people per ££ profit than their illustrious predecessors. The onset of post-industrial decline that will be exacerbated by AI is demonstrating that economic dividends are not shared as widely as perhaps they once were. The phenomenon in the UK of employees being on “zero-hour contracts” and low wages, demonstrates that poverty and financial insecurity is an issue for those in work, not just those out of work. This creeping inequality is a global issue and has increased over the last 40 years in the mature economies of Europe and North America Figure 3 .

From a UK perspective we also have to ask ourselves for example, why is the state pension so low when compared to many other countries in the EU, why do our public services seem so under pressure and underfunded, why is there so much homelessness?

Collectively, the above represent some of the reasons for the increasing volatility of politics in Europe and North America (e.g. Brexit & Trump). Now, in a world with many more dynamic economies, the UK’s place at the “top table” is in the rear-view mirror, and I am not sure the UK is ready for what comes next….especially given Brexit.

Furthermore, the global fiscal regime is morally corrupted if global corporations can legally apply means to minimise their exposure to fair taxes. Many on the right see the internet and the digitisation of money as a means to avoid national fiscal regulation and jurisdiction. A recent blog from Alistair Campbell[xiii] sets out an alarming future and a very real threat. We also know from a very good BBC Panorama investigation[xiv] by Richard Bilton that many of our global financial centres have also become centres for global money laundering, including London.

The evidence is clear global wealth has become concentrated in fewer and fewer people. In fact according to Credit Suisse, the world’s richest 1 percent, those with more than $1 million, own 44 percent of the world’s wealth

Land

In that context, I think we also need to look at land. No one ever made any land (well apart from some good examples, like the Dutch and the Romans with the Gwent levels); and the idea of land ownership is so deeply engrained no-one ever challenges it.

However, many human societies functioned without such “ownership”. Ask the indigenous peoples of North America, Australia or the Amazon Basin what they feel about land ownership.

The truth is land has been appropriated by a very small proportion of us and has been used for generations to generate wealth that has never been shared equitably. We are all custodians of the land, the planet and the environment. To leverage financial influence because of a claim to ownership, is one of the failings of our economies and contributing to the environmental disaster playing out in front of us.

Rampant Consumerism

Perhaps diminishing returns have set in for our economic model, especially in the more developed economies who are rapidly being caught up and overtaken and can no longer base their economies on a disproportionately large share of finite global resources whilst ignoring their responsibility for having caused most of our global climate change problems. It is a moral corruption to stand aside when island nations around the world are threatened with survival.

The stark reality is that the freedoms and choices we enjoy: to live as we do, to buy all sorts of products whenever we want, often with long supply chains and/or built-in obsolescence, to get a new bigger car every 2 or 3 years that we can use whenever we want, to fly easily and relatively cheaply, building on green fields, plastic wrapped exotic fruit or soon to be US imported food, factory farming, the use of damaging pesticides, deforestation, zero-hour contracts, fossil fuel based central heating, poor insulation, etc…

….all these activities have damaging unallocated external costs: environmental, carbon, animal welfare, employee welfare, societal cohesion etc that no-one is paying ….but there is a bill to pay…..and we have to pay it.

As an antidote, I am not wishing to install a soviet style command and control economy – we do need a functioning economy (At least I think we do?). I don’t support ideologically driven widespread nationalisation. I support entrepreneurship (both public and private) and regulated markets; however, we have to consider carefully how we develop and implement some of the radical changes that are clearly needed. We have to view our economy and our environment as being part of the same system. It seems to me the real challenge is how we re-engineer our economy to retain functional coherence but at the same time fully allocate and apportion damaging external costs – especially environmental and social.

However, the best on the right can do is to offer to tax less and on the left to tax income more. Is this the best we can do? I think Piketty had it right, concentrated wealth and asset value, not income, is a big part of the problem. So, I think we need to start with our fiscal systems.

UK Tax

The UK fiscal regime began to take on its “income focussed” modern form with the introduction of an income tax to help fund the Napoleonic wars. The fiscal regime (with and without income tax) developed through the industrial revolution and 19th Century imperial expansion into its modern form today. I would also note it is wholly run from HM treasury at Westminster – the UK is hugely centralised in this regard.

For me, the UK Treasury is too rooted in its past and constrained by the centralised command and control influence of Whitehall, and the increasing dysfunction of Westminster democracy, to be able offer the kind of radical and innovative change we need in the 21st Century.

There are those who argue that we have devolution in Scotland and Wales, and regional mayors in England and that they have the powers to do things differently. I don’t think they do; real power and control and the opportunity to develop and deliver more radical and progressive policy interventions is, in most cases, dependent on having fiscal power and responsibility, not just the administrative “management accounting” responsibility associated with current devolution settlements. Just look at what happened in Wales during Covid and the inability of WG to extend the fire break lockdown because UK Gov would not support an extension of the Covid Furlough scheme at the same time (which was later introduced to support further lockdowns in England); and don’t get me on rail investment or energy.

Policy and decision making are much easier if as a government you can tax, borrow and issue currency. So, for me, the current political settlement in Wales is as much a constraint on progress as is the lack of innovative ideas.

I also think it is also worth arguing that most government policy is overly influenced by those metrics that we can easily count (so Revenue, GDP, Profit, etc) and less so those measures that may be even more important related to societal cohesion, well being and environmental integrity for example. Some countries appear “richer” because of a GDP inflated through economic activities that haven’t properly accounted for the damaging external costs and residual liabilities of those activities.

We have to learn to better count all the things that are important.

Solutions?

Rather than go into a huge amount of detail I just want to throw out a range of ideas for new or modified fiscal measures that I think merit exploration in Wales, The UK, The EU and globally.

Our fiscal regime also needs to be underpinned by some key principles, which I assert, that aside from supporting everyday government expenditure, should be based on a need to:

- To protect and enhance the natural environment

- To address inequality and poverty

- To fund our public services

- To support only sustainable economic growth (and I agree we need to be a lot clearer on what that means and test whether that is even possible or desirable given the climate emergency)

- To support and encourage entrepreneurism and innovation (public and private)

- To enable a functioning economy and regulated markets but measured in terms that reflect well-being as much if not more than GDP.

I am not qualified enough to get into mechanisms & detail, but have, I hope, just enough knowledge to make some valid suggestions that merit further exploration.

External costs

The existential threat of the climate emergency and the environmental catastrophe being unleashed globally requires immediate measures. We need to introduce mechanisms to properly identify, capture and apportion fairly all the currently damaging external costs of our economic activities. If we could do that comprehensively, then what economic growth is left is perhaps, by default, “sustainable”? Many of these are not new ideas and include:

We have and buy too much stuff, too often, that is too big, from too far away…

We should tax built-in obsolescence and waste – too many products and even buildings are now designed, purposely, with much shorter life spans than is both possible and necessary. Making more stuff than we need and discarding it prematurely, requires huge amounts of energy and natural resources; we can’t afford this profligacy. The fact that cars are now just a means to sell a financial service product exemplifies this trend. How many people pay a monthly lease fee with the potential to upgrade their car every two years – just like mobile phones. We have to encourage longevity and re-use to better manage our natural resources.

Similarly, we need to make some things smaller. For example, the popularity of SUVs is another sad feature of the modern world; bigger cars (many with built in obsolescence) require more energy to make and to move, and they take up more space in our crowded towns and cities, making our road more dangerous. Imagine how much more environmentally beneficial it would be for cars to be, say, on average 30% smaller/lighter and designed to last at least ten years. Better perhaps then replacing the current fleet with bigger Electric SUVs. We can use our tax systems to encourage “better” products and better consumer choices.

We also have to consider more punitive taxes for unnecessarily long supply chains; not wishing to diminish New Zealand, but it should not really be cheaper to buy New Zealand lamb (which has been shipped halfway across the world in a flying fridge) in Wales than Welsh lamb. The same could be said of beef from the Amazon given the huge deforestation now occurring to support it.

What and where we build…

One of the most damaging features of our modern world has been to build many new offices, homes, retail, etc in places that can only be accessed using cars (which then require more and excessive use of energy through more road space and more cars). We have to incentives Transit Oriented Development. That means measures to discourage car-based sprawl.

As an example, in the main, the volume house builders have forgotten how to develop sustainable communities. But they did in the Victorian and Edwardian era – just look at the miles of streets in our cities with three or four bedroom town houses using much less land and much easier to live in without having to use the car.

Today, most volume house builders have developed business models around the drip feeding of car-based houses onto greenfield sites – often (not always) with limited consideration of public transport (PT) or active travel (AT) accessibility. This “industry” needs a major re-configuration and will I think need fiscal “encouragement” to do so. So perhaps higher business and domestic rates on properties that are not best located for public transport and perhaps discounts for those based in our town and city centres and/or developed on brown field land. We need to incentivise more gentle density and penalise car based low density sprawl.

More generally our mobility choices should be better regulated fiscally. When you properly account for all the external costs it is clear we subsidise damaging and excessive car use and penalise public transport. We have to grasp this nettle. We need to look at road user charging, removal of free car parking, etc to bring forward innovations and to help us collectively make better mobility choices.

Corporation Tax, Tax Avoidance, Money Laundering and Transaction Taxes…

We also need to look at corporation tax and introduce measures to discourage processes and practices that result in environmental damage, excess energy use, poor animal welfare, poor working conditions and exploitative practices, etc. Clearly, such measures are more difficult to develop and agree vs say just adding n% to taxes on profit; however, we have to find a way of disincentivising processes that cause harm and incentivise those that do not.

Given the potential for further automation and AI to reduce the need to actually employ people, we need to think about taxes that relate to profit per “full time employee” and a sliding scale that see the level of tax increase as the profit per employee increases. This may help better balance how value is apportioned and avoid having a far too high a proportion being allocated to shareholders.

There also perhaps needs to be a sliding scale to tax profits relative to the amount of energy and natural resources that are used to generate that profit. We need to go further than a carbon allowance to restrict some of our environmentally damaging behaviours.

More challenging, new international measure to deal with tax avoidance and money laundering– especially through “offshore” tax havens. In support of the above, we also need global collaboration to develop a global financial transaction tax (“Robin Hood Tax[xv]”), but note this also requires a demanding degree of international collaboration.

Perhaps we can look at accounting standards and ensure that company statutory accounts are prepared and audited with a full estimation and reconciliation of the external costs expended in undertaking a companies activities. There needs to be a reconciled control account for items like: natural resources used, carbon emitted, new land taken, waste produced, etc . We could all make more sustainable consumer choices if such external costs flowed through to the price we pay for goods and services.

Shift from Income Tax to wealth and land…

As Piketty[xvi] argued we perhaps need to focus more on taxing wealth more and income less, so less income tax and more capital gains tax for example.

In that context, we also have to look at land. Perhaps it should be “nationalised” with current owners securing long term leases with conditions in respect of their custodial responsibilities with a “land lease fee” that paid to government (local, regional and national). I dont want a Mugabesque land grab, more a gradual transition to a regime of responsible custodianship that more fairly reflects our collective responsibility for the planet

In that context, in the UK, The Crown Estates is an institution that needs to be “re-designed” for the benefits of people in Wales.

Post Script: This 2017 Oxfam paper re “Billionare Tax” is worth a read

Other more radical ideas: UBI, Time limited money and Tax on All House Sales..

Aligned to more fiscal innovation, perhaps now is the time to seriously consider some form of Universal Basic income (UBI)[xvii]. There has been plenty of debate in this space by those much more expert than me. It is also worth noting that UBI was championed in the 1960s by Richard Nixon[xviii] and Milton Freidman via a negative tax[xix], .and in the US Alaska already operates a form of UBI[xx].

Given the need to ensure more liquidity in local economies, maybe UBI is paid in a new kind of “money” that can’t be saved? It has to be spent within a fixed period of time to help it circulate more quickly and more locally. One of the “problems” with money is that those with more than enough “save it”….but small local economies need liquidity.

We also need measures and incentives to support local economies as a counter balance to more traditional economic development. I have penned a few ideas re bread making & local food retail and crafts in the last few years. We should not under-estimate how damaging car based, high volume out of town retail (esp food) has been to many towns and communities; especially given the greater scope for value extraction via large corporates.

This won’t go down well, but how about Capital Gains tax on all house sales. Much of the volatility of the UK economy has been due to the speculation associated with house prices. A home is not and shouldn’t be a tradeable asset to the extent it is, and such transactions should not have such a disproportionate influence on a national economy.

Another global elephant in the room is the trade in illegal drugs. The war on drugs has clearly failed. This is another potential source of revenue; estimates suggest globally the trade in illegal drugs it is worth $500Bn a year plus all the costs resulting from its criminalisation[xxi]. Let’s legalise, regulate and tax….and then focus on the treatment of addiction and misuse.

Clearly these are complex and challenging proposals and can’t be introduced overnight! And yes, at the same time, we have to do all this whilst trying to support a functioning sustainable economy.

What does this mean for Wales?

Postscript March 2021 – Again referring back to “Doughnut Economics” which I have only recently become aware of (!). my simplistic argument below are framed within the context of our current economic model overly focussed on GDP and growth. Even in that context one can craft an “of course Wales can be independent ” argument. However, the urgent need for all countries to develop societies and economies focussed on well being and living within out planetary means provides even more space to make the case for independence.

The stark fact is that Wales has very few of the powers required to do any of the above. Yet the Welsh economy is more than capable of supporting such fiscal innovation. I am now persuaded, especially as a result of Brexit, to really ask the “independence question” and how a small independent Wales could begin to implement some of these radical policy ideas. I also note that some (not all) will require international collaboration, but that in itself is not an argument against more self determination for Wales.

These three maybe worth a read:

We also need to deal with the oft deployed, “Wales can’t afford independence”, argument. I did try and address some of that in a blog last year[xxii]. But it is worth looking at some of the economic data. Again, I am not the first to do so – and others no doubt have and will do a better job than me.

The 2019 Government Expenditure Review Wales (GERW) analysis[xxiii] indicates, that using UK Treasury data of tax and expenditure, that Wales generates tax revenue of £27BN (approx. 36% of GDP ) and has expenditure of £40.1Bn, leaving an implied deficit of £13.7BN). GERW also says…

The estimates presented in this report reflect Wales’ fiscal position under current constitutional arrangements, and as such, are not a reflection of the finances of an independent Wales.

We do know for example, that Wales is allocated expenditure for items that do not directly benefit Wales (e.g. HS2[xxiv]) and has to carry more costs than a country the size of Wales would normally be expected to (e.g. military expenditure). Furthermore, some of the tax take in Wales is not counted in Wales (e.g. some corporation tax given location of HQ).

Postscript May 2021: HMRC does publish its methodology for apportioning taxes collected (see p23) – inc Corp Tax. Where numbers of employees by nation area available then some Corp tax is apportioned accordingly, where that is not the case than the tax is recorded at the location of the Corp HQ (thanks to Wales Governance Centre for clarification)

In reality, even based on its current less than optimal economic structure, an independent Wales would likely have a higher tax take and a lower expenditure level than officially reported. How much can be argued – but based on the current allocation of expenditure and taxation the budget deficit of an independent Wales is likely to be materially lower than £13Bn calculated by GERW.

We also need to acknowledge that tax and spend policy of an independent Wales need not and surely will not, reflect that adopted by Westminster and the current Senedd. Like any small independent nation, it can and will develop its own policies in respect of tax and expenditure.

From the OECD and Eurostat data, whilst in UK terms Welsh GDP/capita is low, it is not low in global terms. On that basis Wales is a wealthy nation with a total economy in GDP terms worth ~£75Bn or about £24,500 ($33,000) per capita – about 75% of the UK [xxv]. In comparison from GDP per capita (current US$) | Data (worldbank.org) Italy was $32,000, Poland $33,000 Portugal $22,000, Slovakia $19,000 and the world average is about $17,000. More starkly Ireland is now $85,000 whereas UK as a whole is only $41,000. It is clear that Wales is not a poor country!

Like above, if all Wales’ economic activities were properly recorded in Wales, its total GDP is also likely to be somewhat higher than official figures. Let’s for the sake of argument and the analysis below, say Wales current budget deficit is £10Bn (£3Bn lower than GERW) and its GDP is £78Bn (£3B higher than official figure). We can use international comparators to build a reasoned (and yes simplistic) argument as follows…

Figure 7 UK Budget deficit Vs GDP (The House of Commons Library )

First, it is worth noting that the UK budget deficit Figure 7 has been an average of 3.4% since 1970[xxvi], which has contributed to UKs national debt, which is now nearly 100% of GDP[xxvii] (£2Tn ). This is a high-water mark in recent years but is low when viewed over a longer time period; for example, it was over 200% after the second World war Figure 8 . Today, many other countries have a higher %age budget deficit than the UK. Figure 9. Today, Covid is also challenging many assumptions of how we manage our economies, and interventions that did not seem possible or practical now are.

Figure 8 UK National Debt Vs GDP (BBC)[xxviii]

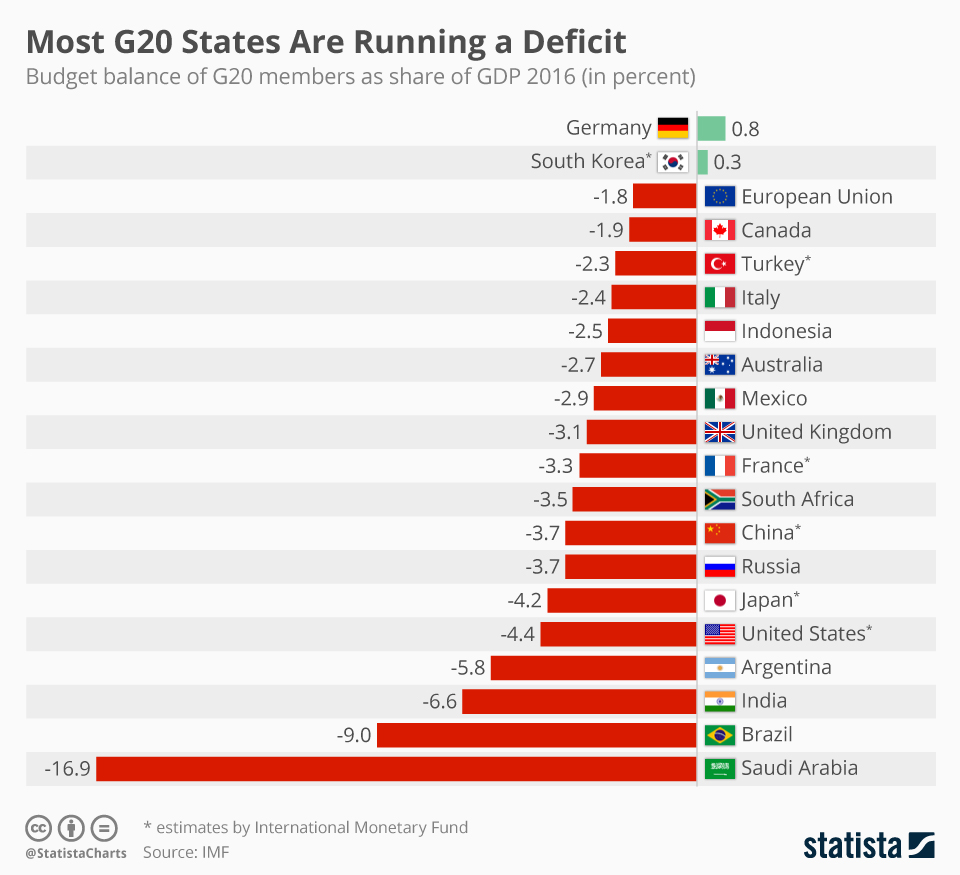

Figure 9 – G20 budget deficits Vs GDP

Then note, in terms of tax receipts, the United Kingdom ranked 23rd out of 37 OECD Figure 10 countries in 2019[xxix] with a tax-to-GDP ratio of 33.0% compared with the OECD average of 33.8%. The average rate in the EU is 41%[xxx] with Denmark and France the highest on approximately 45% Figure 11. PS- These figures do vary year on year and now post Covid are likely to be higher to a degree for all countries, many of whom responded by “printing” more money.

Figure 10 Tax take as %age of GDP (OECD 2019)

Figure 11 Eurostat 2020 – Tax to GDP Ratio

So, rather than be constrained by a UK mindset and GDP/tax ratio of 33%, perhaps a more progressive 40~45% deployed by many EU counties would be more socially responsible. This is where we could perhaps begin to introduce some of the more radical fiscal ides I suggested above.

If Wales did increase its tax/GDP ratio by say 10%, that could generate a further £7~8Bn in tax revenue. In addition, if Wales, as most countries do, serviced a budget deficit of perhaps £2~3Bn (3-4% of GDP), then it could “fill “that nominal GERW £10Bn budget deficit.

There will be those that raise the impact of marginal tax increases on overall tax take, of how tax will restrict economic activity, of how any transition to independence will be disruptive and damage GDP in the short term, and how the current UK National Debt should be apportioned, etc. Yes, I understand, and yes, we need to look in more detail, and yes it won’t be easy (unlike Brexit!).

However, I have used data from around the world to provide a benchmark, the known limitations in current official figures in assessing Wales current fiscal position, and more importantly acknowledge that as an independent country Wales would be able to develop its own fiscal policies.

Postscript: In addressing some of the comments (thank you for those) I acknowledge yes this wont be easy and we need a lot more detail, debate and analysis. But to respond…

Looking at the Welsh-UK GDP gap is useful but this simplistic analysis of the “wealth gap” needs to acknowledge and recalibrate to better reflect all the damaging external costs associated with how GDP and “wealth” is created and calculated, and especially the need to better reflect those damaging external costs and liabilities in all our economic induces. At some point all governments are going to have to “get their heads around this” .

This short paper from the Zoe Institute of Future Fit Economics on transitioning to more sustainable Welfare Systems is also helpful

If damaging external costs were properly allocated and flowed through to the price of consumer products and services, then I suspect we would have a different looking economy and no such “Welsh GDP gap”

Welsh “Independence Transition and Infrastructure Investment” 100 year Bonds…

Clearly for Wales the transition to “independence” will have real short term financial cost and leave it with potential liabilities, such as pensions (PS Oct 2022 – Prof John Doyle in his paper challenged the pension argument, and calculated a fiscal gap in the early days of an independent Wales to be approximately £2.6bn). However, pensions are a common feature of many developed economies (China is particularly at risk in this regard). On the former and the transition costs and risks, perhaps any new Welsh Government can issue long term (100 yr?) “independence transition and investment bonds”. In the short term this could help the financial transition but also support investment in key sustainable connectivity and energy infrastructure. I dont see any reason not to amortise the costs of this transition over a long period. (Eg the updated HS2 business case has included consideration of an appraisal period of 100 years). This will be more than enough time to transition the Welsh economy. More generally I think “climate emergency transition bonds” may and should become more common in other countries to help accelerate the changes required to deal with the climate emergency head on.

I acknowledge my argument is still a little disjointed and light. However I’d rather we focussed energy and effort to really think this through and generate new and innovative ideas as well as a means to address the real challenges we will face. It is easy for all of us to fall prey to straw man and knee-jerk arguments for why things cant be done. Change takes effort, thought and commitment; but change can happen.

The above also implies as some have commented, that we need more maturity, expertise and plurality in out political debate in Wales. I agree. This also applies in part in many other places (including the UK and US), exacerbated by the rise of “anti-expert” populism and the weakening of independent news media.

Finally, I am not as some suggest, seeking “to wrench” ourselves away from friends and neighbours in England, or anywhere for that matter (in the way Brexit is doing). As the EU demonstrates it is possible to “pool sovereignty” and work as fellow nations without building walls – physical or metaphoric. This is about more responsibility, equity and respect…..and less about command and control

So, on that basis, I (still) have no doubt that it is perfectly possible (and yes difficult) for even the current constrained Welsh economy to support an independent nation state. In fact, it would be odd, given all the other small independent and economically sustainable countries around the world if Wales could not.

As Michael Sheen[xxxi] said, those arguing that Wales is too small, too stupid or too poor, would perhaps rather we did not ask these sorts of questions… in case we answer them!

The fundamental question it seems to me, is not whether Wales could be independent, its whether it wants to be? Equally important is the question of whether Westminster is working for Wales and whether the status quo is really an option ?

Clearly, this needs more expert analysis than I am able to offer in a short blog; and it does need to be set against the kind of functioning economy that is in balance with nature and our environment, as well as reflecting the impact of Covid. I have just tried to set out some principles and I hope the basis of a persuasive argument in favour of a more radical approach in Wales.

In doing so, we cannot avoid the need for Wales to secure the powers to do this; and they won’t come from Westminster. We need to take some responsibility and do it ourselves.

ENDNOTES…..

[i] Climate Change, Brexit and The Economy (…and Wales) – Mark Barry (swalesmetroprof.blog)

[ii] What sort of Wales do we want? – Mark Barry (swalesmetroprof.blog)

[iii] Transit Oriented Development in the Cardiff Capital Region….

[iv] A Public Transport Grid for the M4 Corridor… – Mark Barry (swalesmetroprof.blog)

Driverless cars as a service, batteries and urban spaces… – Mark Barry (swalesmetroprof.blog)

[v] Global Extreme Poverty – Our World in Data

[vi] Life Expectancy – Our World in Data

[vii] wir2018-summary-english.pdf (wid.world)

[viii] Global Economic Inequality – Our World in Data

[ix] Number of rough sleepers in England has increased more than 250% since 2010 – Our World in Data

[x] Life Expectancy at Birth, Total for the United States – St. Louis Fed

[xi] Evidence | Facts – Climate Change: Vital Signs of the Planet (nasa.gov)

[xii] IPCC — Intergovernmental Panel on Climate Change

[xiii] the Brexit revolutionaries have barely begun. Britain needs to wake up fast | Alastair Campbell

[xiv] BBC iPlayer – Panorama – Banking Secrets of the Rich and Powerful

[xv] Tax the Banks | Robin Hood Tax

[xvi] Thomas Piketty, “Capital in the 21st Century”

[xvii] The introduction of a universal basic income – House of Commons Library (parliament.uk)

[xviii] The bizarre tale of President Nixon and his basic income bill – The Correspondent

[xix] Milton Friedman, 1962 “Capitalism and Freedom”,

Milton Friedman on Guaranteed Income / Negative Income Tax / Basic Income – YouTube

[xx] Universal Basic Income is gathering support. Has it ever worked – and could it work in the UK? | National Geographic

[xxi] Transnational Crime and the Developing World « Global Financial Integrity (gfintegrity.org)

[xxii] What sort of Wales do we want? – Mark Barry (swalesmetroprof.blog)

[xxiii] Government-Expenditure-and-Revenue-Wales-2019.pdf (cardiff.ac.uk)

Wales_Fiscal_Future_FINAL.pdf (cardiff.ac.uk)

[xxiv] Wales and HS2… – Mark Barry (swalesmetroprof.blog)

[xxv] Regional gross domestic product and gross value added: 1998 to 2018 | GOV.WALES

[xxvi] The budget deficit: a short guide – House of Commons Library (parliament.uk)

[xxvii] UK national debt highest since 1960s after record October borrowing – as it happened | Business | The Guardian

[xxviii] UK debt now larger than size of whole economy – BBC News

[xxix] UK Tax to GDP Ratio – Revenue Statistics OECD

[xxx] Tax to GDP Ratio EU – Eurostat 2020

[xxxi] Michael Sheen: Why he gave back his OBE, Welsh independence, Brexit and the year of COVID – YouTube

Mark,

A well written and considered piece which is thoroughly researched and commendable.

However, the points you raise make it clear to me that the case for independence is political. I.e. those championing welsh independence are doing so not for ‘sovereignty’ or ‘self determination’ as a right, but because they want to take Wales in a different political direction. The ‘yes campaign’ should be honest about that.

The floor in the welsh independence argument is not a financial one, it’s a democratic/political one. There is no sign of a functioning opposition in Wales, it is not clear what it would mean for the Labour Party torn as it is across the U.K, there is no effective media scrutiny and frankly very little history of checks and balances. To date the devolved administration has been more like a large local authority than a national government.

The argument is often made that if Wales was given primary law making powers then politics would change, suddenly the public would take note, form effective oppositions, demand checks and balances and effective scrutiny, but history is not their side. It can take a very long time for functioning democracies to mature and frankly I don’t want the next 50 years to be the ‘trial and error’ years of Welsh politics. Nationalising land for instance would certainly make the public take note… it could start a civil war!

The idea that greater power is what’s needed to foster greater responsibility is incredibly reckless. Whilst in theory, and eventually, I can’t see why Wales couldn’t been an ‘independent nation’ in practise an awful lot could go wrong in the interim (which could last decades). Responsibility must come before power not the other way around.

To convince me otherwise I would want to see an effective policy engine in Wales, from both sides of a political spectrum, generating ideas which were debated and sharpened in the cauldron of political debate. I would want to see viable competition for governance, leaders winning power at elections not installed mid-term by their predecessors. I would want to see a free press with a cabal of ferocious investigative journalists holding our leaders to account and unearthing inevitable corruption and scandals. Regrettably all of this is missing.

The biggest barrier the Yes campaign faces is not the tallying of sums on a ledger, brexit has shown that is not paramount. It’s convincing the citizenry that it won’t upset the apple cart. It won’t shepherd in an immature one party state intent on taking the country off in a completely different direction.

The reason this matters is because most Welsh people at heart know that they are not different to our English & Scottish family. We wake up to the same tv shows and eat the same cereal, we support the same sports teams, we shop in the same shops, we holiday in the same places, we laugh at the same jokes and love the same books. Why would we want to divide ourselves from our family, our neighbours, our friends?

The desire to separate Wales from our U.K. family is a political drive to satisfy dissatisfaction with the prevailing U.K. political view. Whilst there is lots to complain about, the costs and risk associated with wrenching us from our family, friends and fellow Britons is a ridiculous way to impose a particular political point of view.

Anthony

LikeLiked by 1 person

Thanks for the challenge…I did reflect & respond a little in a postscript. I would also argue that the UK does not have a “free press” – those barons who run the Express, Sun, Mail have a lot to answer for in respect of dumbing down debate and feeding the brexit beast with simplistic disinformation.

LikeLiked by 1 person

Thank you Mark,

On the press, of course not perfect but regardless of political bent they do love to dig up sleeze, which I think is useful.

On the wider question, and similarly I am light on exact detail, i think the answer lies in a new regional constitutional settlement as part of a reform to the House of Lords. Call it a Senate, or Federal system if you like. But to me the problems you highlight for Wales are shared by other regions in the U.K. and rather than starting from scratch with nation building, with all the disruption that involves, it would be far smoother to modernise the constitution to embrace regionalism and ensure an equitable balance.

Evolution not revolution.

Kind regards

Anthony

LikeLiked by 1 person